how much federal tax is taken out of my paycheck in illinois

There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. Illinois Hourly Paycheck Calculator.

State Individual Income Tax Rates And Brackets Tax Foundation

Your household income location filing status and number of personal.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. How do I figure out the percentage. What percentage is taken out of paycheck taxes.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. How much taxes is taken out of a paycheck in Illinois. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding.

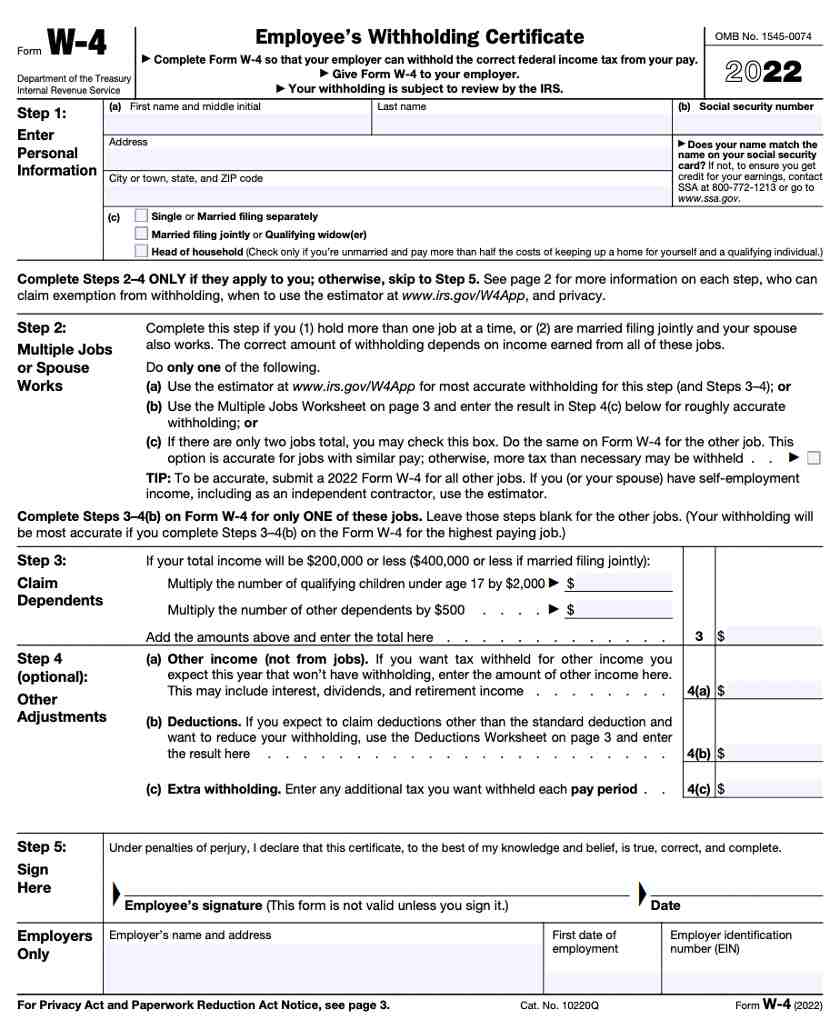

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois. Use this tool to. These amounts are paid by both employees and employers.

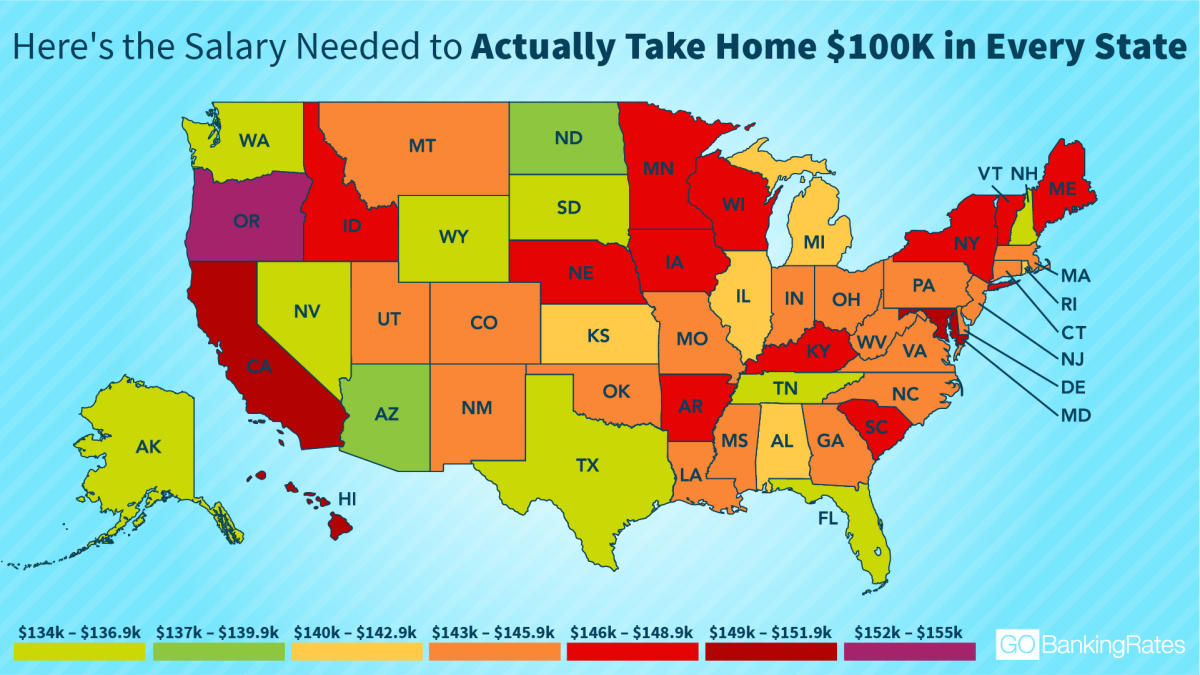

Your employer will withhold money from each of. How much is 75k after taxes in Illinois. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

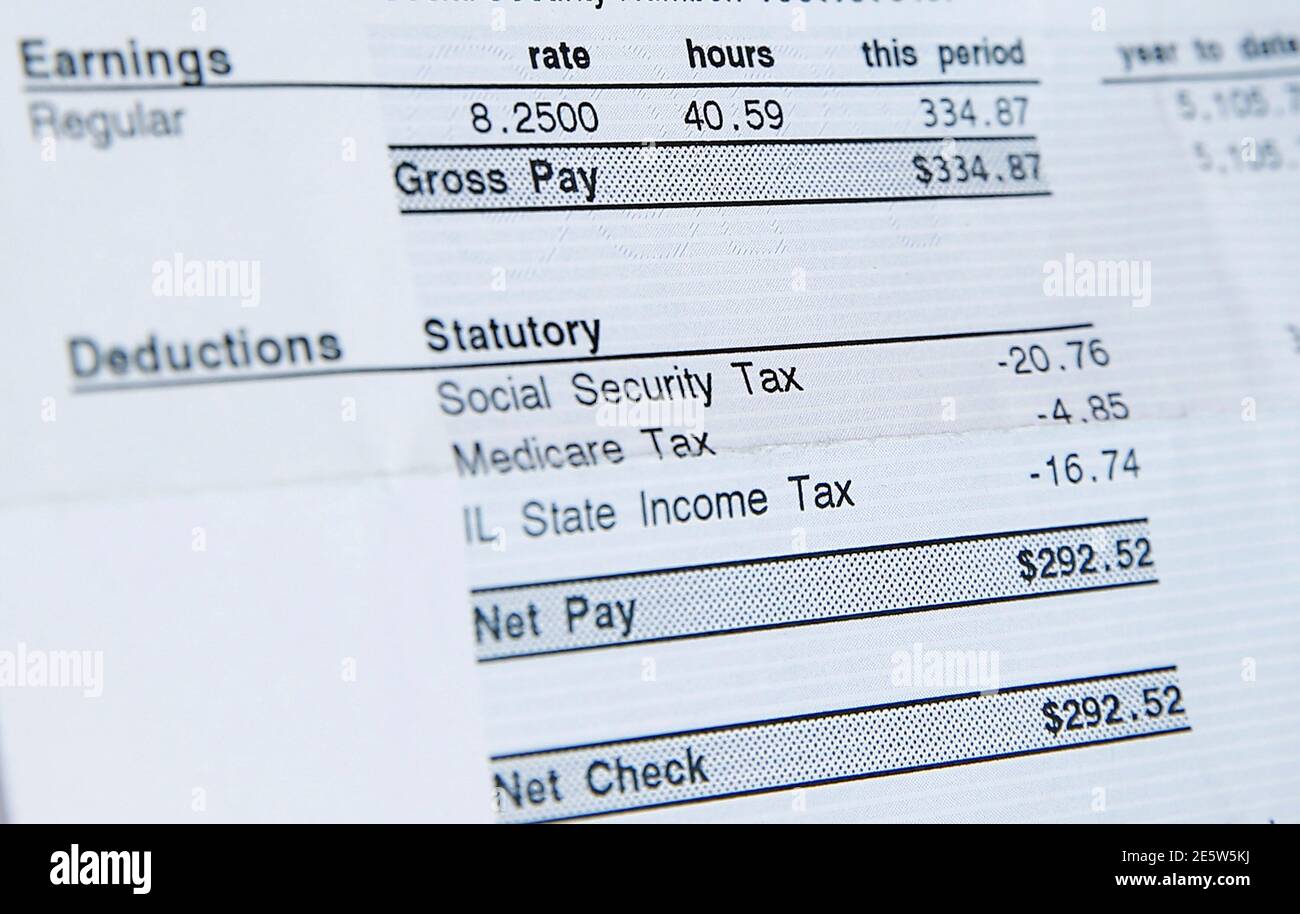

See where that hard-earned money goes - Federal Income Tax Social Security. How Much Taxes Get Taken Out Of Paycheck In. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

See how your refund take-home pay or tax due are affected by withholding amount. For 2022 employees will pay 62 in Social Security. The wage base is.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. Well do the math for youall you need to do is enter.

How much is 90k after taxes in Illinois. Personal income tax in Illinois is a flat 495 for 20221. Estimate your federal income tax withholding.

FICA taxes consist of Social Security and Medicare taxes. How It Works. Some states follow the federal tax.

The state tax year is also 12 months but it differs from state to state. Illinois tax year starts from july 01 the year before to june 30 the current year. Just enter the wages tax withholdings and.

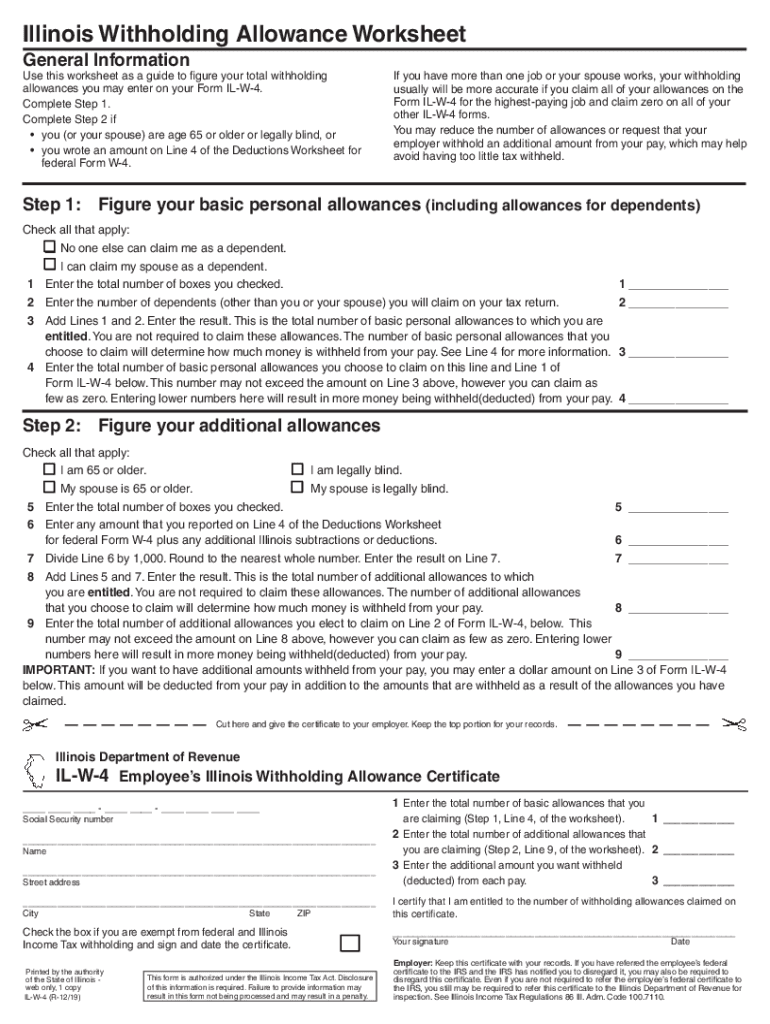

Our calculator has recently been updated to include both the latest Federal Tax. On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202223.

How much is 75k after taxes in illinois. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

W 2 Vs W 4 Differences When To Use Each

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Tax Withholding For Pensions And Social Security Sensible Money

How Many Tax Allowances Should I Claim Community Tax

This Is The Ideal Salary You Need To Take Home 100k In Your State

Are Pensions Taxable In Illinois

What Are Employer Taxes And Employee Taxes Gusto

State W 4 Form Detailed Withholding Forms By State Chart

A Recent Paycheck For Delores Leonard Shows Her Hourly Wage Of 8 25 For Working At A Mcdonald S Restaurant The Minimum Wage In Illinois In Chicago Illinois September 29 2014 Leonard A Single

How To Read Your Paycheck Stub Clearpoint

Illinois Paycheck Calculator Smartasset Com

Here S How Much Money You Take Home From A 75 000 Salary

What Is The Illinois Withholding Tax Il 941 Pasquesi Sheppard Llc